What makes tax legislation understandable to taxpayers?

There are clarifications and consultations on certain provisions that may seem contradictory.

As it is well-known, the State Tax Service provides individual tax advice on specific requests of taxpayers in such cases. In turn, the Ministry of Finance of Ukraine has the authority to issue Generalized Tax Advice, which can be used by any taxpayer.

With this regard, the Ministry of Finance has established a special permanent advisory body, the Expert Council. It gathered specialists from the Ministry of Finance, the State Tax Service, the Verkhovna Rada Committee on Finance, Tax and Customs Policy, business associations, independent experts in accounting and taxation, lawyers and auditors. The experts of the EU4PFM Program are also among its members.

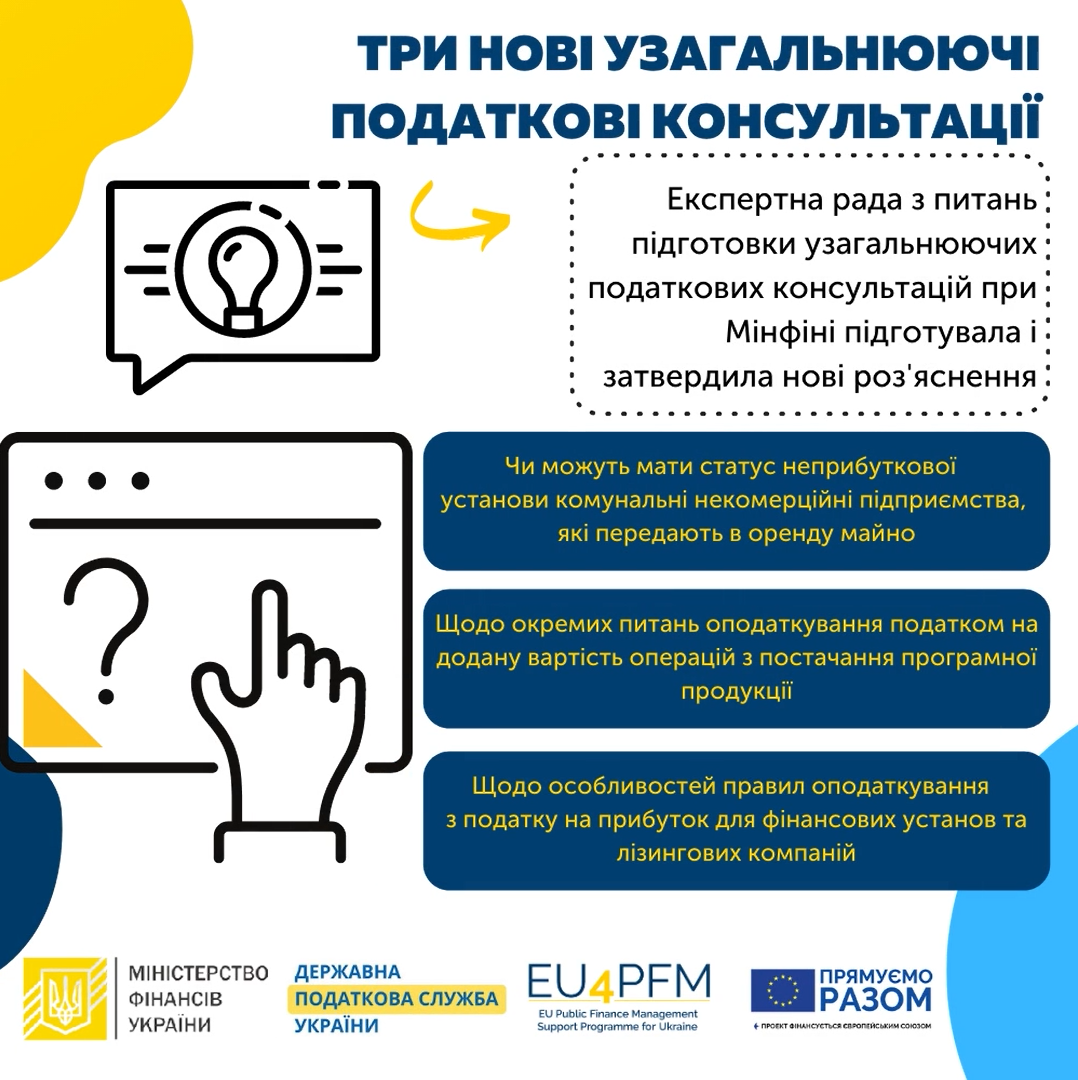

During December-November 2020, the Expert Council worked on several issues, and in early January 2021 the Ministry of Finance approved three new documents:

- Generalized tax advice on certain issues of VAT transactions for the supply of software products. The text could be found via: https://bit.ly/2YbuILg

- Generalized tax advice on whether communal non-profit enterprises that lease property could have the status of non-profit organization. The text could be found via: https://bit.ly/3p3Sd4y

- Generalized tax advice on the specifics of income tax rules for financial institutions and leasing companies. The text could be found via: https://bit.ly/3c6UTT4

In the working groups of the Expert Council, the work continues on issues of transfer pricing, international taxation, application of the 20-OPP form. We are looking forward to receiving newest clarifications in the foreseeable future.

in total, since the establishment of the Expert Council in 2017, the body has issued 22 of these consultations. The full list is available via: https://bit.ly/3iBYrGj