EU Public Finance Management Support Programme for Ukraine is searching for: International Key Expert on tax (IKE2).

On December 15, a remote seminar for members of the European Business Association on “Practical aspects of the procedure for obtaining the status of the Authorized Economic Operator (AEO)” was held. In total 50 participants attended the event.

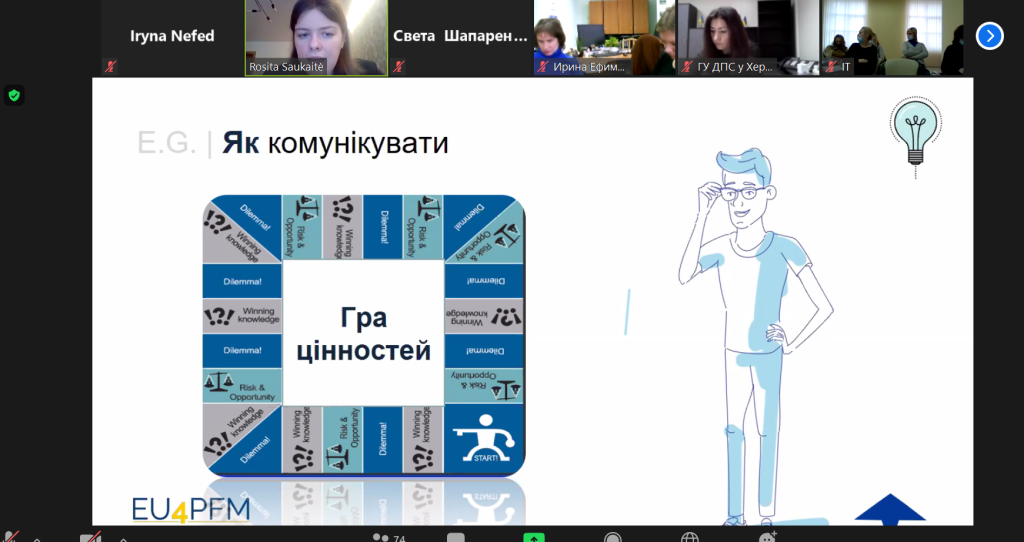

Today, on 16th of December, EU4PFM conducted a training on Effective Internal Communications for managers and HR teams of the Central Office and representatives of regional units of the State Tax Service of Ukraine. Total of 160 participants from all over Ukraine joined the training.

On December 18, the first Coordination Meeting of the State Tax Service together with partners and representatives of international technical assistance projects took place.

With the support of EU4PFM, the State Tax Service has developed a single tax account, an account that every taxpayer can open through an e-cabinet and use to pay liabilities and/or tax debt of tax payments and fees and unified social tax. Using a single tax account simplifies the administration of taxes and saves a…

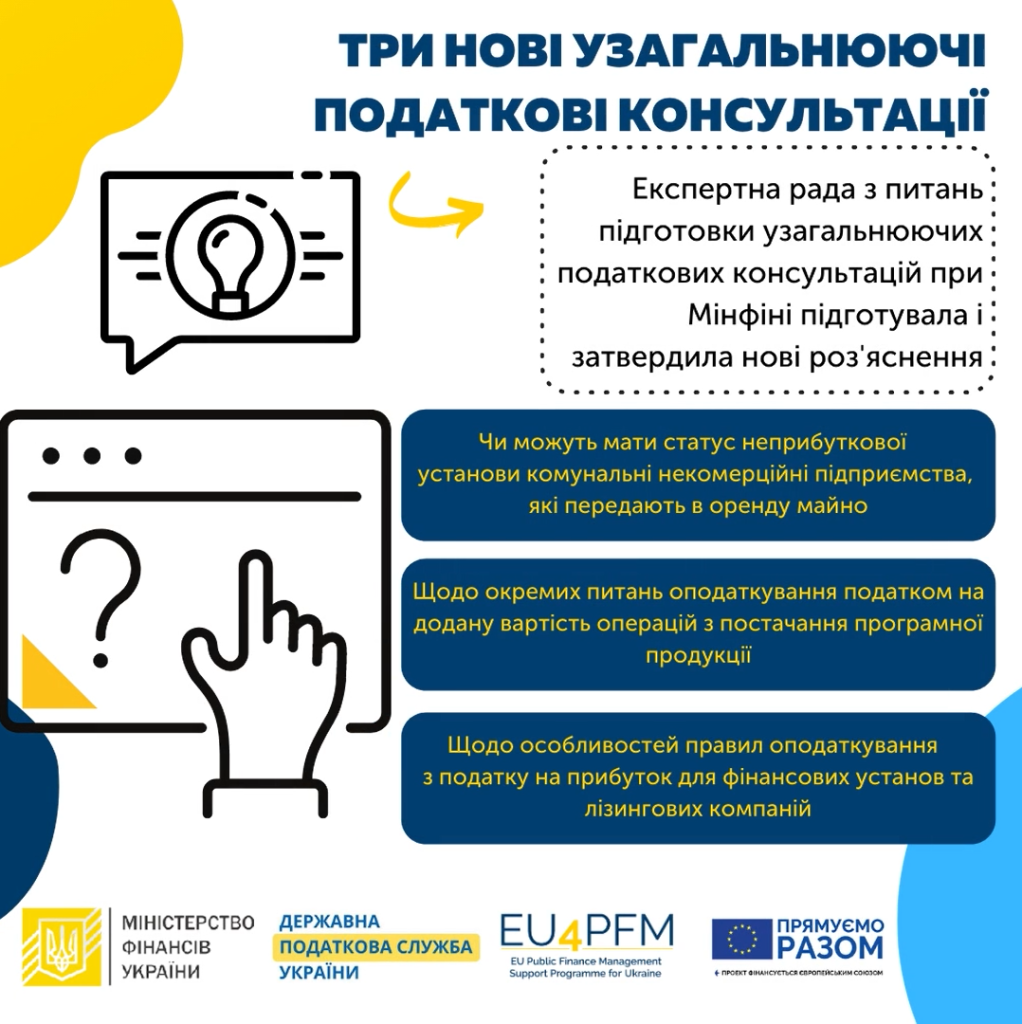

There are clarifications and consultations on certain provisions that may seem contradictory. As it is well-known, the State Tax Service provides individual tax advice on specific requests of taxpayers in such cases. In turn, the Ministry of Finance of Ukraine has the authority to issue Generalized Tax Advice, which can be used by any taxpayer.