Paulius Majauskas, Head of Tax and Customs Administration Division. Ministry of Finance of the Republic of Lithuania, International Expert on taxation in the EU4PFM Program shared thoughts about one of the most crucial tax reforms, which is observed not only by Ukraine but also by its international partners. This is the digitalization of the tax…

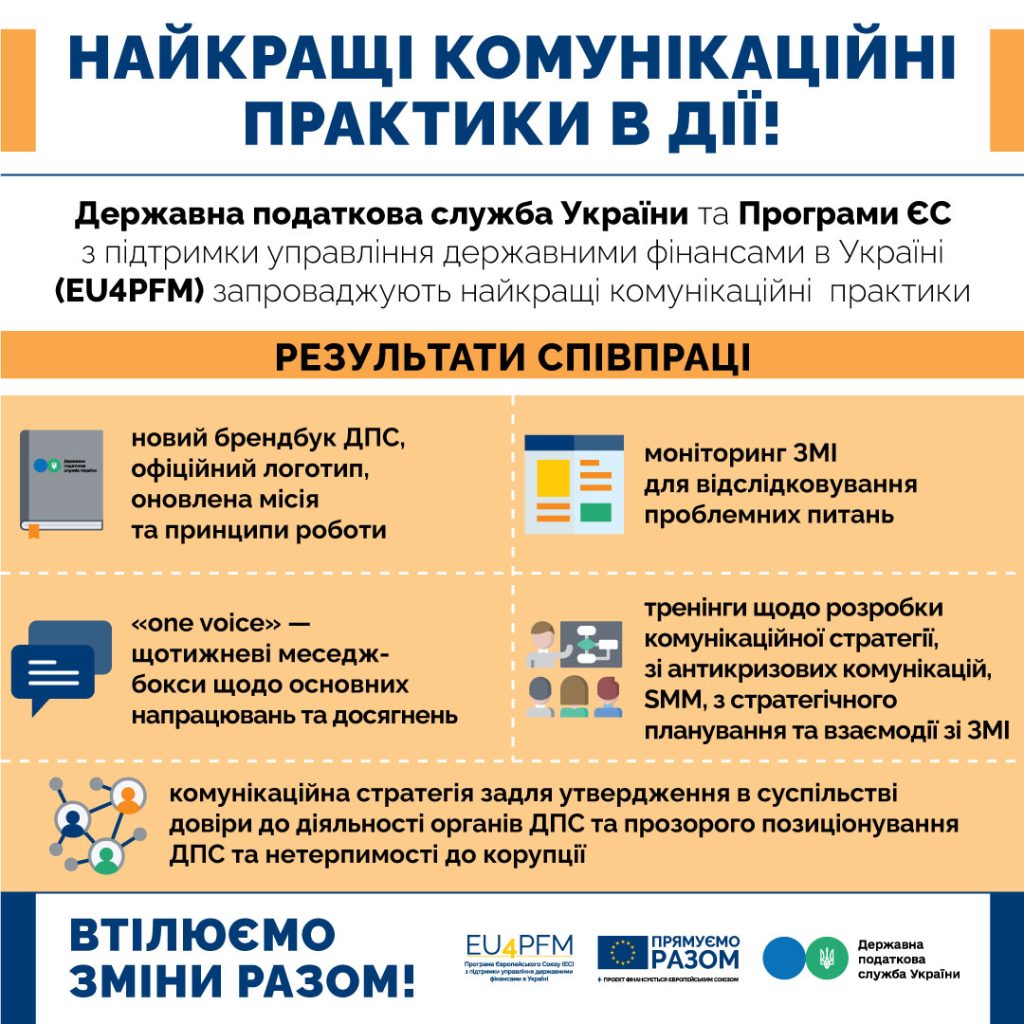

The State Tax Service of Ukraine and the EU4PFM Project are actively cooperating in the implementation of best communication practices.

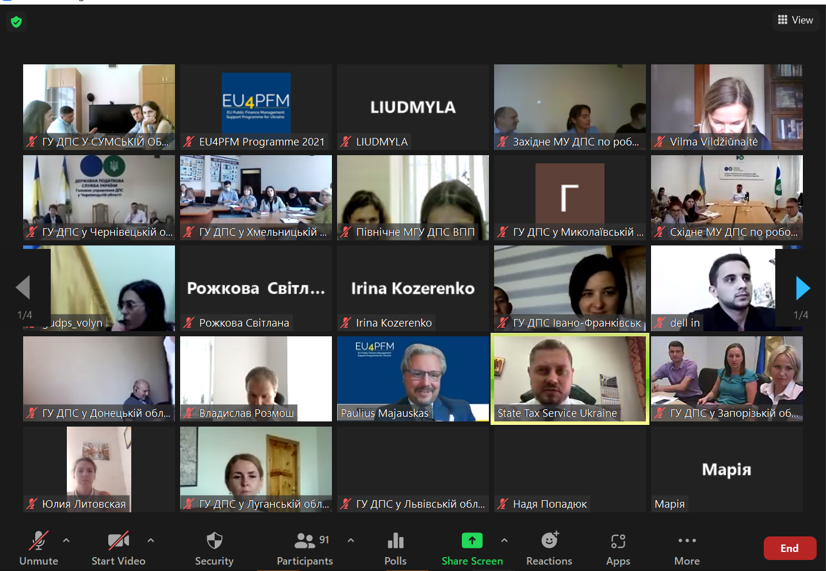

European best practices in tax disputes were presented for EU4PFM partners. More than 300 employees of the central office and the Main Departments of the State Tax Service of Ukraine, who work in the areas of court support and administrative appeals, took part in the workshop

On September, 7th, the Ministry of Finance of Ukraine together with the Committee of Entrepreneurs on Tax Issues of the Ukrainian Chamber of Commerce and Industry/Ukrainian CCI 7 presented the draft of the Procedure for establishing compliance of the conditions of controlled operations with raw materials under the arm’s length principle. The draft document was…

Paulus Mayauskas Head of the Customs and Tax Administration of the Ministry of Finance of Lithuania, EU4PFM International Key Expert on tax reform. An invisible work that later demonstrates visible results is the development and implementation of a regulatory framework that harmonizes Ukrainian legislation with European legislation.

Vitjanis Ališauskas, International Key Expert on Customs of the EU Public Finance Management Support Programme for Ukraine (EU4PFM) shared his thoughts with European Truth If Ukraine seeks greater economic integration with the EU, the priority should be the establishment of mutually clear customs rules and procedures.