The 1st Coordination Meeting of the State Tax Service with partners and representatives of international technical assistance projects took place

On December 18, the first Coordination Meeting of the State Tax Service together with partners and representatives of international technical assistance projects took place.

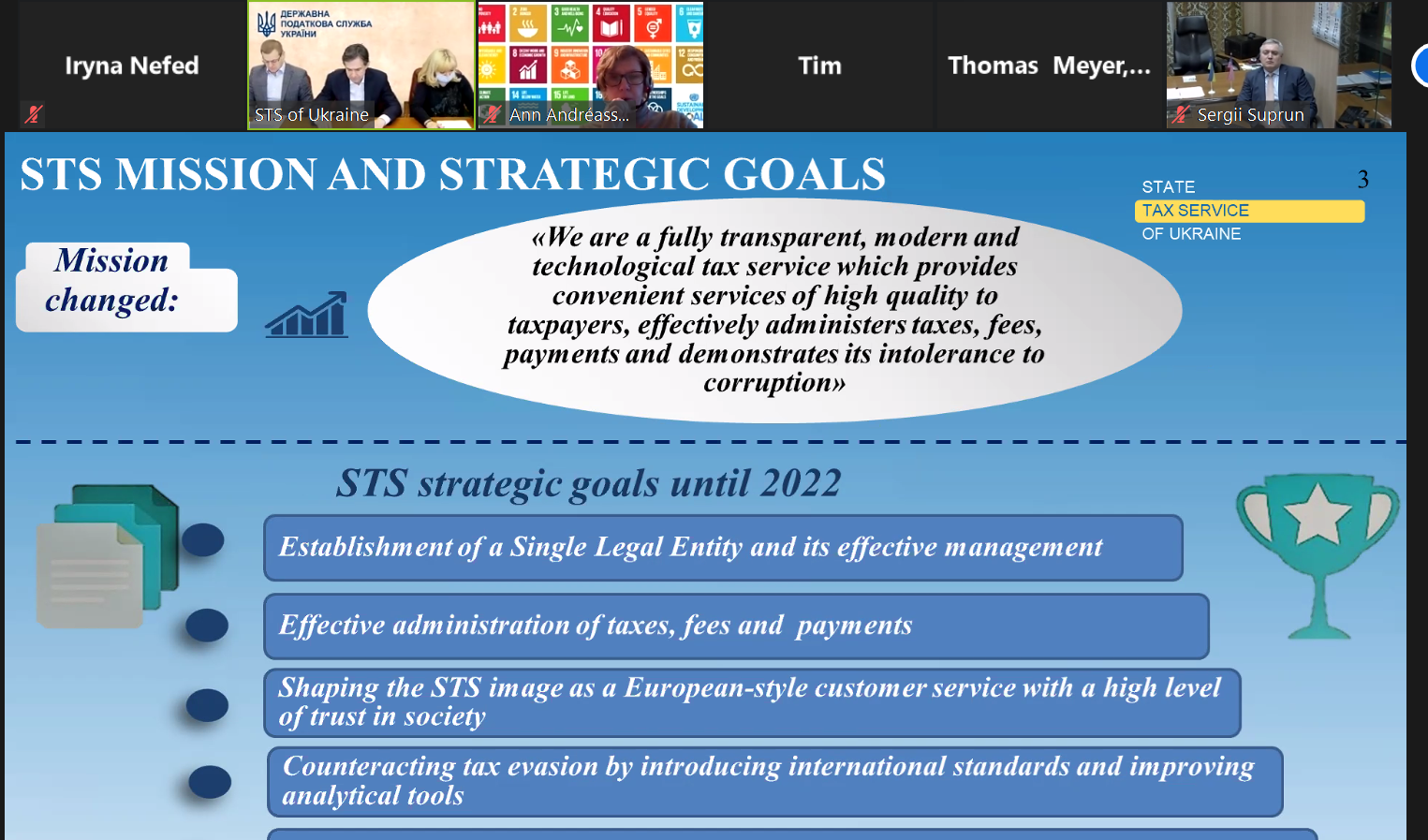

Mr. Oleksiy Lyubchenko, Chairman of the State Tax Service of Ukraine, informed key international partners on the results achieved in 2020 and plans for 2021.

The meeting was held in an online conference format with the participation of representatives of the Delegation of the European Union to Ukraine , EU4PFM, the International Monetary Fund (IMF), the Department of Technical Support of the US Treasury, GIZ and METS.

“This year, the State Tax Service managed to fulfill all key goals. This applies to the revenues collected from taxes and fees, and improved tax administration. One of the most important achievements is the finalization of work on the creation of a single legal entity of the State Tax Service. And also digitization of the services for taxpayers “, – Mr. Oleksiy Lyubchenko noted.

According to his words, one of the strategic directions for the State Tax Service in 2021 will be a comprehensive internal audit of the Service’s functionality. It will last from three to six months, and will end with concrete developments of changes to regulations. Such changes should increase the efficiency of administration and digitalize some of the procedures to avoid the subjective human factor.

International partners identified the activities on assessing the risks of tax evasion as one of the priority goals for the State Tax Service for 2021. The STS is actively working in this direction. Thus, a relevant unit has been created to develop a compliance strategy.

Mr. Jurgita Domeikiene, EU4PFM Team Leader, thanked the SCS Chairman for the close cooperation and the effective coordination of technical assistance projects. Among the priorities, Mr. Jurgita Domeikiene mentioned the transition into a single legal entity, support for enhancing the business processes of the STS, improving the quality of advisory services, implementing a risk management system, establishing global initiatives, improving STS communication and public awareness of tax culture.

The participants of the meeting noted the consistency and persistence of the State Tax Service in the implementation of reforms during 2020.