How Ukraine succeeded in staying well on track with the implementation of PFM reforms, even in wartime

It is almost one year since russia launched its unprovoked attack on Ukraine and the country continues to fight struggle for its freedom in this brutal war.

Team Leader

Looking back, it’s hard to imagine how our partner institutions have managed to cope with massive missile attacks, energy supply problems, and tremendous losses, while still providing Ukrainians with uninterrupted basic services. The EU Public Finance Management Support Programme for Ukraine (EU4PFM) did not simply observe – while russia was attempting to destroy Ukraine – we have continued to build. And I am truly proud to declare that the EU4PFM project proved itself as a reliable partner, fully engaged in this resistance.

“While russia was destroying, we continued building”

To meet the requirements for full-scale EU membership, the European Union provides support to Ukraine for each step on this path. In 2022, the EU4PFM, as an EU-funded programme worked hard to speed up Ukraine’s integration, making every effort to bring the much-desired goal closer. Inspired by the courage shown by the Ukrainians on the battlefield, here, behind the scenes, the EU4PFM Team accelerated all resources to present tangible results that would help Ukraine not only to become a fully-fledged member of the EU but to recover and prosper within the shortest timescale possible.

Long story short, I would like to recall key Project achievements from the second half of 2022 which were made possible due to the joint efforts of the Ukrainian Ministry of Finance, the State Tax Service, the State Customs Service and the valued support of the European Delegation to Ukraine.

What we’ve managed to achieve

In the 2nd half of 2022, being as flexible as possible, and with the willingness of partner institutions, we succeeded in increasing the volume of our project activities. This was achieved despite the difficulties related to energy supply, directly influencing our communication with partners. During the first half of 2022, the project’s focus was on emergency support (you can read about this in detail, here). In the second half of the year, our primary objective shifted to Public Finance Management (PFM) reforms and the EU integration agenda.

“There was an increase in the volume of project activities, despite the difficulties related to energy supply which directly influenced our communication with partners”

Compared to the situation one year ago, the project’s budget execution increased from 32 to 55 percent. This is illustrated by the achievements that I would like to share with you in the following paragraphs.

In the customs stream the key event was Ukraine’s accession to the Convention on a Common Transit Procedure and the Convention on Simplification of Formalities in Trade in Goods. Put simply, this means that the Customs Visa-Free Regime came into effect in Ukraine. Since 1 October 2022, Ukrainian businesses have been benefiting from much faster customs clearance of goods between the common transit countries. The EU4PFM project, together with the Ministry of Finance and State Customs Service, continue to provide support in raising the awareness of entrepreneurs on recent changes. We organised a large-scale event – the Customs Platform: Ukraine-EU 2022 for all stakeholders and held workshops with more than 1000 engaged business representatives. Infographics and other information materials regarding new opportunities for the international use of NCTS in Ukraine were also presented, and now we update them on all our platforms on a regular basis.

Additionally, ongoing work continues on topical issues to bring Ukrainian legislation into line with that of the EU. Our experts are involved in the development of a customs audit, the practical application of the EU customs legislation on protecting IP rights and assisting in the drafting and assessment of Ukrainian legislation on Amendments to the Customs Code. In the end, Ukraine will establish new customs legislation that meets EU standards, ensuring the ability to fulfil the obligations of EU membership in this respect.

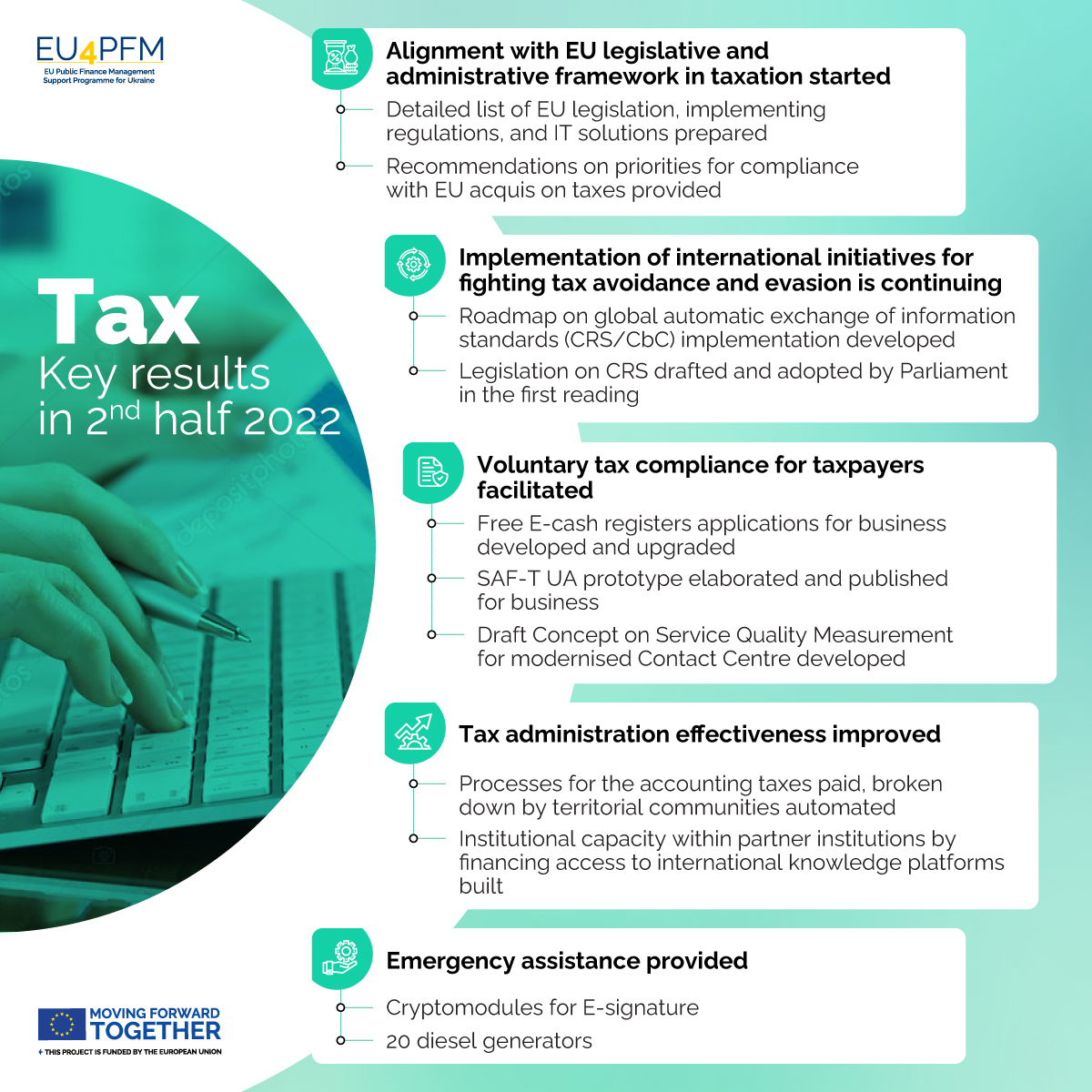

With regard to tax policy, Ukraine is on a positive track, too. As with the customs stream, last year EU4PFM worked on an approximation of Ukrainian legislation in line with the tax legislation of the EU. To this end, we were able to contribute to the preparation of a detailed list of EU legislation, implementing regulations and IT that was further discussed with Ukrainian partners.

Another activity stream was supporting the implementation of international initiatives for fighting tax avoidance and evasion. We assisted in the development of a roadmap for the implementation of the Global Automatic Exchange of Information (CRS/CbC). The instruments on automatic exchange of information about the financial accounts of individuals (CRS – Common Reporting Standard) and the profit of multinational companies (CbC – Country-by-Country Reporting), allow us to combat tax evasion and profit shifting without increasing tax rates for cooperating businesses and individuals. More than 100 jurisdictions participate in the global exchange of information networks, and this year, Ukraine is going to introduce CRS. As of now, the relevant legislation has been adopted by parliament at the first reading.

EU4PFM supports initiatives that demonstrate a client-oriented approach in tax administration. A good example of this, is the development and upgrade of e-cash register applications for businesses. Following current best practices, together with the State Tax Service we introduced free tools which are used for the automatic calculation of incomes and minimising compliance costs for taxpayers.

Budget process modernisation – a new stream of the project

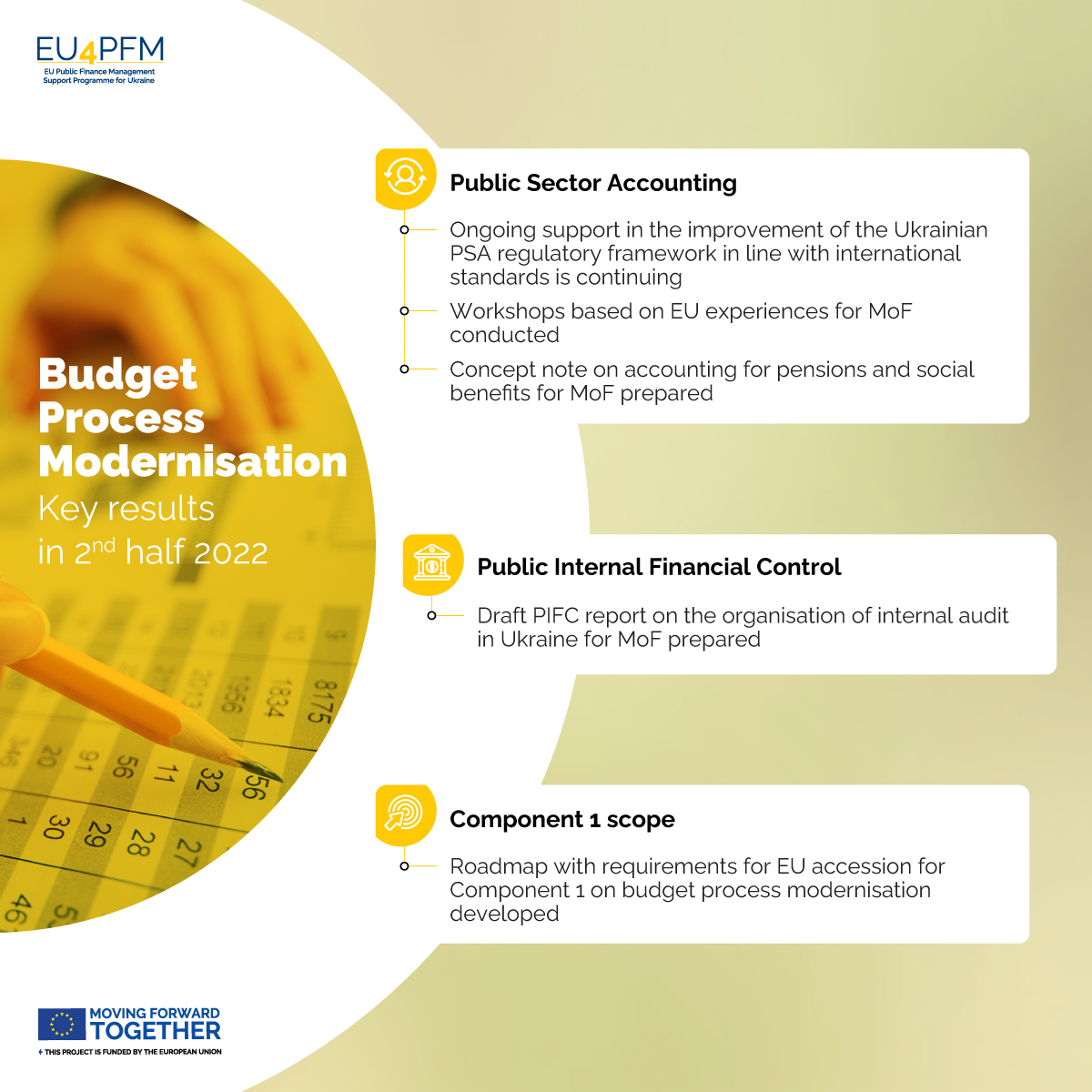

Another achievement of 2022 was the fully-fledged launch of Component 1 of the project, dedicated to budget process modernisation. Together with the Ministry of Finance, we cooperated to reform the financial sector in Ukraine. Activities on the development of an IT solution for budget planning and monitoring were resumed – the technical documentation was finalised and the tender procedure for procurement launched. EU4PFM international experts had already held a series of workshops, where they shared with Ukrainian colleagues the best European experiences in reforming public sector accounting and public internal financial control. In addition, they also elaborated on a roadmap with the relevant requirements for EU accession, concept notes, and draft reports, which will later form the basis of ground research and contribute to strengthening our state institutions’ capabilities in the relevant spheres.

Last but not least is the HR stream. To provide support to our partners, the project is engaged in the development of a modern human resource management system. We continue our work in deploying a competence-based approach in HR management. For example, the development of a library of questions to check competencies during any interviews at the MoF. A handbook for newcomers for the SCS and MoF was developed as well. We continue to deploy EU best practices in HR management into the current Ukrainian transformation agenda.

Without doubt, all of these achievements, are important, but for me, as a Team Leader, the fact that we have succeeded in saving all of our national experts team is of key significance. Without them the work achieved would not be as substantial as it is. Another source of pride is that we managed to gather together all our partners and the European Delegation to Ukraine at the summit in Vilnius. This occasion provided a great opportunity to meet each other offline and consider the progress made in the implementation of the project, which resulted in planning further activities and assistance throughout 2023 and beyond.

As I mentioned at the beginning, the goal of the EU4PFM team is to contribute to the recovery process of Ukraine in the field of public finance management. In this regard, when planning activities for 2023, we were guided by Ukraine’s Recovery Plan to follow the same reform agenda, providing effective assistance and comprehensive support that really is in demand for our partners. So I would like to shed some light on our plans for 2023 in the public finance management sector.

EU4PFM priorities for 2023

Our efforts in 2023 in the customs stream will be dedicated to the further implementation of NCTS Phase 5 which will include user acceptance and conformance testing, user training, a transition from NCTS Phase 4 to Phase 5, preparation of new customs legislation for Ukraine and the introduction of the best EU practices in the field of customs policy. As with customs, in the tax stream, we are to continue working on alignment with the EU legislative and administrative framework, the implementation of OECD standards of transparency and information exchange, and on the improvement of tax administration effectiveness. In the budget stream, besides ongoing work in public sector accounting and public internal financial control, we will be launching our activities concerning the medium-term budgetary planning process.

Finally, I would like to emphasise how this extremely difficult time with daily destruction and enormous losses could not stop us, but instead, only enhance our support and future recovery developments.

Jurgita Domeikiene, EU4PFM Team Leader