Role of Communication within Risk Management Frameworks. Edition №4

Ensuring effective communication within risk management frameworks is crucial for mitigating potential threats and fostering a culture of transparency and accountability. In the final edition of the educational rubric on risk management, we delve deeper into this pivotal topic.

Question 1: What is the role of communication within risk management frameworks?

Answer 1: Communication plays a pivotal role within risk management frameworks. It fosters transparency, trust, and informed decision-making among stakeholders, facilitating the development of risk responses and promoting accountability in risk management.

Q2: What are the different levels within an organisation that have risk accountabilities and responsibilities?

A2: Various levels within an organisation bear risk accountabilities and responsibilities, including senior management, the audit committee, second-line functions, operational management (first line), employees, and internal audit.

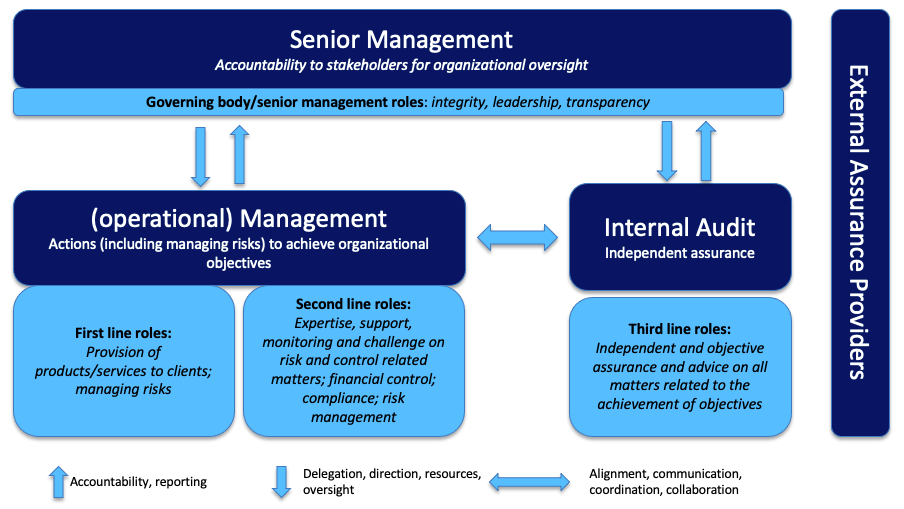

Q3: Describe the Three Lines Model by the Institute of Internal Auditors (IIA).

A3: The Three Lines Model, recognized by the Institute of Internal Auditors (IIA), delineates the responsibilities of various parties in effective risk management and governance.

The model operates with three distinct lines:

Q4: According to the IIA Three Lines Model, how do roles collectively contribute to the creation and protection of value?

A4: The IIA Three lines Model emphasises that roles collectively contribute to value creation and protection through alignment achieved via communication, cooperation, and collaboration, ensuring the reliability, coherence, and transparency of information necessary for risk-based decision making.

Q5: What are the information needs and requirements of senior management?

A5:

- Understanding the critical risks of the organisation.

- Grasping the potential impact of deviations from expected performance areas on all stakeholders.

- Ensuring adequate risk perception and awareness throughout the organisation.

- Knowing how the organisation handles specific risks.

- Understanding the significance of stakeholders trusting the organisation.

- Understanding the effective management of a risk-reporting communication strategy with stakeholders.

- Ensuring the effectiveness of the risk management process.

- Publishing a clear risk management policy that reflects the philosophy and responsibilities of the risk management process.

Q6: What are the key principles of communication with senior management within a risk management framework?

A6: The key principles of communication with senior management include simplicity, relevance, and regularity. It is important to use clear and concise language, tailor information to specific needs, and establish a consistent communication schedule to keep senior management informed about evolving risks and mitigation strategies.

Q7: How should senior management receive the desired risk-related information?

A7: Senior management should receive information regarding key risks related to business objectives through various means such as dashboards (e.g., Business Balanced Scorecard), risk paragraphs, and visuals.

Q8: What is the role of the Audit Committee in the context of risk management?

A8: The Audit Committee plays an oversight role by reviewing audit results and key consolidated risk information, providing a platform to discuss risk and audit priorities, and maintaining clear communication lines with second- and third-line functions. However, it should not take over the responsibility for risk management but rather communicate concisely to senior management and feed management with risk awareness to facilitate decision-making processes.

Q9: What are the information needs and requirements for second-line functions within a risk management framework?

A9: Second-line functions need to analyse and consolidate risk information, present it to the Audit Committee and senior management, and maintain formal communication and collaboration with internal audit. They are responsible for developing external communication instruments such as annual plans/reports and must communicate changes in procedures and key performance indicators to the first line and employees.

Q10: What are the information needs and requirements for operational management (first line) within a risk management framework?

A10: Operational management should be aware of risks within their scope of responsibility, have performance indicators to monitor critical business activities, and have systems in place to report variations in schedule, costs, performance, and other areas. They should also promptly inform second-line and senior management of any new or perceived risks.

Q11: What are the information needs and requirements for employees within a risk management framework?

A11: Employees need to understand their responsibility for individually managing risks, continually improving their response to risk management, and contributing to the organisation’s risk management culture. They should inform senior management promptly about any uncertainty, new risks, or failures of existing risk control measures.

Q12: What are the key aspects for effective risk management communication?

A12: Effective risk management communication involves appropriate and timely involvement of stakeholders at all levels, providing the right information in a timely manner, integrating risk management information into existing management reporting, and communicating with stakeholders outside the organisation.

Q13: Provide an example of external communication related to risk management.

A13: In the Netherlands, the annual report of a ministry often contains a paragraph addressing various aspects including exception reporting for components with risks related to lawfulness, non-financial accounting information, budget management, financial management, material operations, and other aspects of business operations. It may also cover government-wide governance issues and risks such as IT, integrity, and shared services, as well as major developments and improvements in business operations.