Ukrainian business uses a convenient and modern tool – a Single Tax Account for paying taxes

Starting January 1, 2021, Ukrainian business uses a convenient and modern tool – a Single Tax Account for paying taxes.

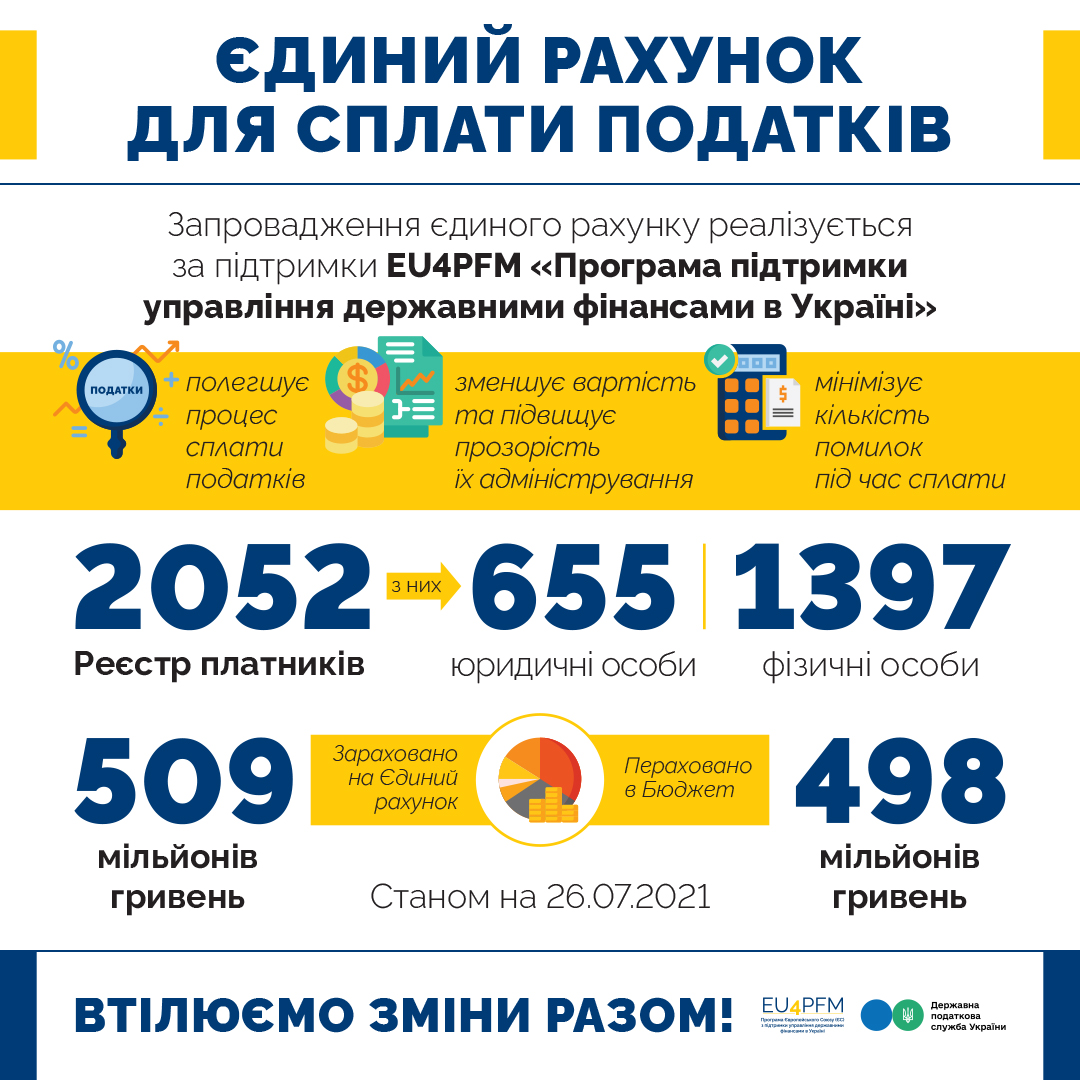

The Single Tax Account is implemented at the initiative of the State Tax Service of Ukraine and with the support of the European Union Public Finance Management Program in Ukraine (EU4PFM), which provides expert assistance in developing regulations, internal procedures, and financial assistance in the development of IT solutions.

“An important direction of reforms is to support a modern and fair tax system. We offer solutions that have already been tested and proven to be effective in the world, – says Paulius Majauskas, International Key Expert on taxation in the EU4PFM Program. – A Single Tax Account is a profitable and convenient tool for the taxpayer. It significantly simplifies the administration of taxes. The entrepreneur transfers the amount to this account, and all taxes are already paid from it. No one fills out extra bills or forms. The EU4PFM has provided support for the implementation of this instrument.”

To use the advantages of paying taxes to the Single Tax Account in one click you need to take three simple steps:

- to submit “Notification on the use of a single account” through the Electronic Cabinet on the form J / F 1307001;

- to receive a receipt for inclusion in the Register of payers who use a Single Tax Account;

- to provide the servicing bank with settlement documents indicating the details of the Single Tax Account for the total amount without determining the recipients or with determining the recipients. The Single Tax Account tool has been successfully operating for seven months in the State Tax Service of Ukraine and its popularity is gaining momentum. It simplifies the process of paying taxes, reduces the cost of its administration for taxpayers, and minimizes the number of errors during payment.

- Let’s implement changes together!