Aligning Accounting and Budget Classifications. Edition №2

This edition provides insights drawn from EU member states as well as the UK and third countries about the integration of budget and accounting classifications, characteristics of coding systems, organisation of the codes, the recommended model for future developments, and initial proposals for Ukraine.

Q1: Why is the integration of budget and accounting classifications deemed ‘good practice’?

A: According to the IMF paper ‘Budget Classification in: Technical Notes and Manuals Volume 2009 Issue 006 (2009)’, it is generally considered to be good practice for the budget and accounting classifications to be completely integrated. In some Anglophone countries the chart of accounts is used to record both budgetary and financial data in the government accounts.

Another approach is to ‘harmonise’ the two systems by keeping them separate and complete but bridging the differences between them using special tables.

There is also the ‘partial approach’, for example in Francophone countries where the integration between the budget classification and the plan compatible has been limited to the economic classification (with revenue and expenditure classes).

Finally, in some countries the accounting and budgeting classifications are entirely separate and can differ in terms of structure and content.

The integration of budget and accounting classifications is considered good practice because:

- The absence of one-to-one correspondence leads to loss of information.

- It enables the identification of the accounting implications of budgetary operations.

- Complete data supports accountability and decision-making at the government level.

- Accounting standards focus on comprehensive disclosure, ensuring transparency of government operations.

Q2: What is the significance of the ‘Clear Line of Sight’ project in aligning budgeting and financial reporting?

A: The ‘Clear Line of Sight’ project, initiated in 2009 in the UK, aimed to provide a unified set of data for both budgeting and financial reporting. As a result of the project, the majority of transactions are recorded in budgets and financial statements at the same value and within the same period. This alignment fosters greater trust in public sector accounting and enhances transparency. However, some alignment issues persist, particularly regarding classification.

Q3: What model for aligning coding systems is recommended for consistent data and information disclosure?

A: The recommended model for aligning coding systems includes:

- Ensuring consistent information about government spending within and between organisations.

- Using a summarised taxonomy of the chart of accounts for both budgeting and financial reporting purposes.

- Avoiding withholding of data and ensuring accuracy and comparability of financial information.

Q4: What are the key characteristics of the UK government’s Standard Chart of Accounts?

A: The UK’s Standard Chart of Accounts has the following key characteristics:

- Consists of no more than eight numeric digits.

- Can be used as a single source of classification codes for both budgeting and financial reporting purposes without any amendment or additional sets of codes.

- Detailed enough to support the presentation of income and expenditure by nature.

- Ensures consistency with the definitions found in the IFRS conceptual framework.

Q5: What are the implications of the codes used in the Standard Chart of Accounts?

A: The implications of the codes used in the Standard Chart of Accounts include:

- Consistency with international financial reporting frameworks (IFRS, IPSAS).

- Systematic and detailed presentation of income and expenditure.

- Limited entity-specific information embedded in the codes.

Q6: How are the codes in the Standard Chart of Accounts organised?

A: The codes in the Standard Chart of Accounts are organised contiguously into different categories:

- Non-current assets (NCAs), including PPE and Intangible Assets.

- Current assets (CAs).

- Non-current liabilities (NCLs).

- Current liabilities (CLs).

- Taxpayers’ equity.

- Income.

- Expenditure, including suspense accounts.

Q7: How do differences in recognition rules between budgets and accounts manifest?

A: The fact that a single coding structure exists will not prevent the budget and the accounts showing different values on certain accounts. This mainly affects whether a transaction should be considered a ‘capital’ or ‘revenue’ item.

In the UK, the annual published guidance lists transactions that are accounted for differently in the budget and the financial statements of the spending units. The same transactions can (and should) be valued at the same amount and in the same period but they are sometimes permitted to be classified differently. This means that despite careful, global alignment of the two coding structures for budgets and accounts, transactions can be posted to different accounts.

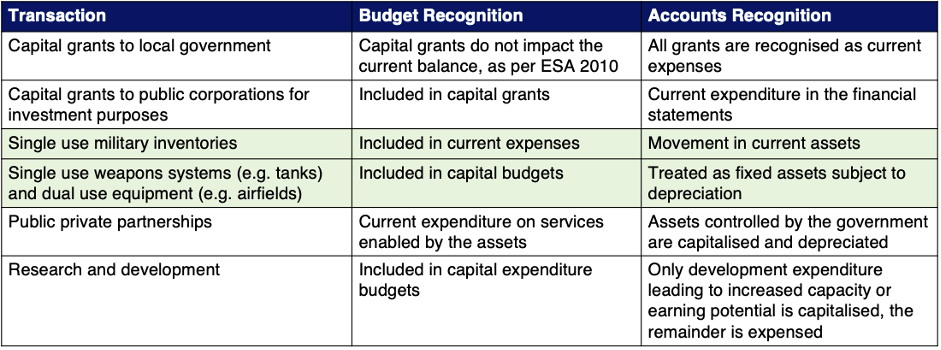

Q8: What are the examples of different (and the same) recognition rules in the UK’s budget and accounts?

A:

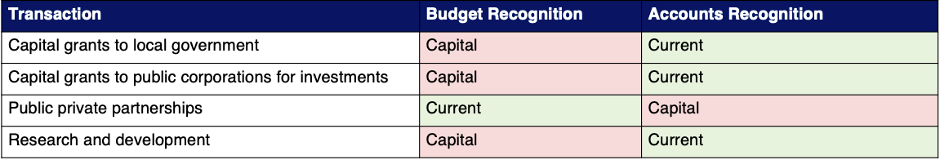

Q9: How to reconcile the misalignments between budget and accounts?

A: These misalignments are deliberately retained in the UK financial management system:

Q10: How will these differences affect the integrity of the financial statements showing budget and actuals?

A: They will create differences between the budget and accounts due to the different allocations to either current or capital expenses.

Q11: What are the conclusions drawn regarding the Budget Classification system?

A: Conclusions regarding the Budget Classification system include:

- It is deliberately held separate from the classification of codes in the Chart of Accounts.

- It consists mainly of codes supporting cash-basis budget execution reporting i.e. nine separate schedules relating to the budget current account, essentially reporting on how the budget deficit is funded or government debt repaid.

- Expense and revenue ‘economic’ account codes are often very specific to the public sector (e.g. judge’s remuneration, state licence plates, accessories for decorating uniforms).

- The expense codes are designed to record cash purchases of assets or payment of expenses rather than the balances of assets and liabilities.

- There are only just over 200 active expense codes, not enough to support detailed recording of the nature of expenses, let alone the movements on asset and liability accounts.

Q12: What are the conclusions regarding the Chart of Accounts in the UK?

A: The Chart of Accounts in the UK:

- Accounts relating to the elements of international-standard financial statements (not including memorandum, intra-government transfers or off-balance sheet accounts) occupy 606 lines. It is more capable of reporting financial elements by nature than the budget economic codes but is still much smaller than the UK’s Standard Chart of Accounts.

- The utility of the Chart of Accounts could be enhanced if budget classification codes (where relevant) and a considerable number of new sub accounts were added to it.

- Current and noncurrent assets and liabilities as found in IFRS and IPSAS are not listed contiguously in the Chart of Accounts. For example, inventories, which are considered current assets, are listed in the same series of codes as non-current non-financial assets.

- Sections (classes 3 and 4) analysing transactions relating to the funds and balances controlled by government and transfers between budget-funded entities are entity-centric classifications that do not exist in the UK’s Standard Chart of Accounts.

Q13: What recommendations are provided for Ukraine for developing future classification systems?

A:

- Redesign the chart of accounts to include all the additional accounts required for compliant general-purpose budget and financial reporting omitting all duplicate and irrelevant codes.

- Create a sufficiently comprehensive single set of codes following the design principles of simplicity and consistency.

- Position inventories, receivables and investments in the redefined chart of accounts under current or non-current assets depending on when they are likely to be converted into cash (within 12 months for current assets or longer for non-current assets).

- Keeping codification about entities and their transactional interrelationships outside the scope of the chart of accounts while recording transactions accurately and in real time within a fit-for-purpose financial accounting system.

- Continually keep the utility of the chart of accounts under review and do not hesitate to make changes if necessary e.g. at the start of each accounting year. Ensure that those changes are fully communicated to relevant practitioners.