Results 2021: TOP-5 Achievements in Tax area

The EU4PFM project has summed up the results of activities in 2021.

The TOP-5 results in each area of the project’s cooperation in the PFM field with partner institutions in Ukraine: the Ministry of Finance of Ukraine, the State Tax Service of Ukraine, the State Customs Service of Ukraine, and the Accounting Chamber of Ukraine prepared for a public audience.

Today we share the key achievements in the Tax area.

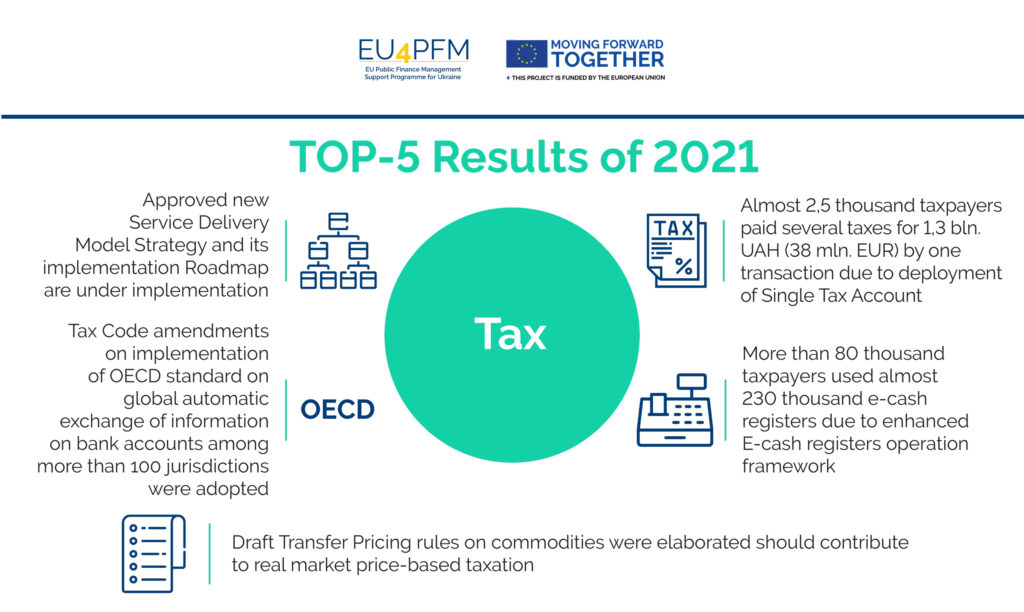

Among the TOP-5 common achievements of the EU4PFM project with partner institutions:

- Approved new Service Delivery Model Strategy and its implementation Roadmap are under implementation.

- Tax Code amendments on implementation of OECD standard on global automatic exchange of information on bank accounts among more than 100 jurisdictions were adopted.

- Almost 2,5 thousand taxpayers paid several taxes for 1,3 bln. UAH (38 mln. EUR) by one transaction due to deployment of Single Tax Account.

- More than 80 thousand taxpayers used almost 230 thousand e-cash registers due to enhanced E-cash registers operation framework.

- Draft Transfer Pricing rules on commodities were elaborated should contribute to real market price-based taxation.

Moving forward together!